There are 14M rooms available today

14 Jun 2024There is a large unused letting capacity in the UK right now, with more than 14 million spare bedrooms sitting in the hands of homeowners and landlords in England & Wales alone. If some of these were rented, it would make it more profitable for homeowners and landlords, cheaper for tenants, and beneficial for the market in general by increasing the supply of available space.

Figures from the Census '21

Although there is consensus that the supply crisis pushes rents up, little is said about how we use the existing housing capacity today.

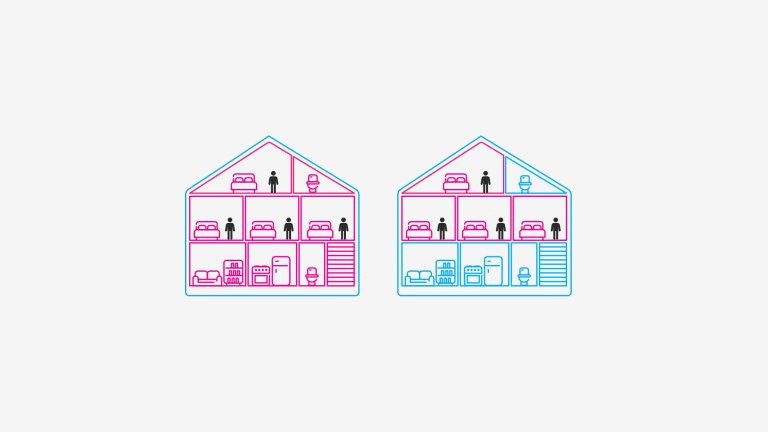

When looking at the census 2021, there were 14.3 million dwellings with one or more spare bedrooms available in England & Wales at the time (excluding social housing). Here is how they are distributed:

- Homeowners make the bulk of it with 10.8M households with at least one bedroom available in their home.

- Private landlords rent to 3.5M households with at least one spare bedroom.

In Bristol, there were 135.3K spare bedrooms available in 2021, of which 91.5K were in homeowners’ hands and 43.8K in rented properties. Using some of this space would drastically increase the availability of rooms for tenants and the income for homeowners and landlords.

How can we harness this unused capacity?

Let’s look at how homeowners and landlords can take advantage of this.

Homeowners

Homeowners are the largest housing tenure in the UK, and we have seen more of them taking in lodgers in recent years. Here are two easy ways whereby homeowners can help alleviate the supply crisis:

- Rent-a-room. Homeowners can increase their revenue up to £7,500 free of tax thanks to the Rent-a-Room scheme. Having up to two lodgers will not trigger the House in Multiple Occupation (HMO) regulations, thus making it a straightforward and low-cost option.

- Downsize to smaller properties. With an ageing population, many homeowners living in large family homes can downsize and release their properties back into the market, freeing up some of the underused capacity that is otherwise unavailable. This will not suit everyone of course, but there is a lot to gain by making downsizing easier for the elderly.

Landlords

Landlord renting to sharers can easily increase their revenue whilst reducing rent to tenants. However, many landlords refrain from doing so because the HMO regulations make it more demanding to rent to sharers than families. Also, some landlords may have mortgages unsuitable for HMOs, as described in my previous article. To overcome this, two simple steps can make a big difference:

- Apply for a licence. This opens up more space for tenants and increases revenues for landlords.

- Joint tenancy HMO. Adopt Buy-to-Let mortgages compliant with joint tenancy HMOs, which are cheaper than traditional HMO mortgages, as explained in the article mentioned above.

Note that renting rooms or subletting should be discussed with all the parties involved and must be done following the relevant regulations to avoid fines for landlords and potential eviction of tenants.

Using this capacity would benefit the rental sector enormously.

If only 1% of homeowners and landlords with a spare bedroom opened it up to a lodger or an additional sharer, it would release 142K bedrooms in England & Wales. In Bristol, it would make an extra 1,353 rooms available today.

Overall, this strategy brings more rooms onto the market, reduces pressure on rents, and increases revenue for homeowners and landlords alike.

Let us look at what we have in our hands to help solve this crisis together, today, for good.

Boris Drappier